Top 7 Minimalist Spending Habits That Reduce Decision Fatigue

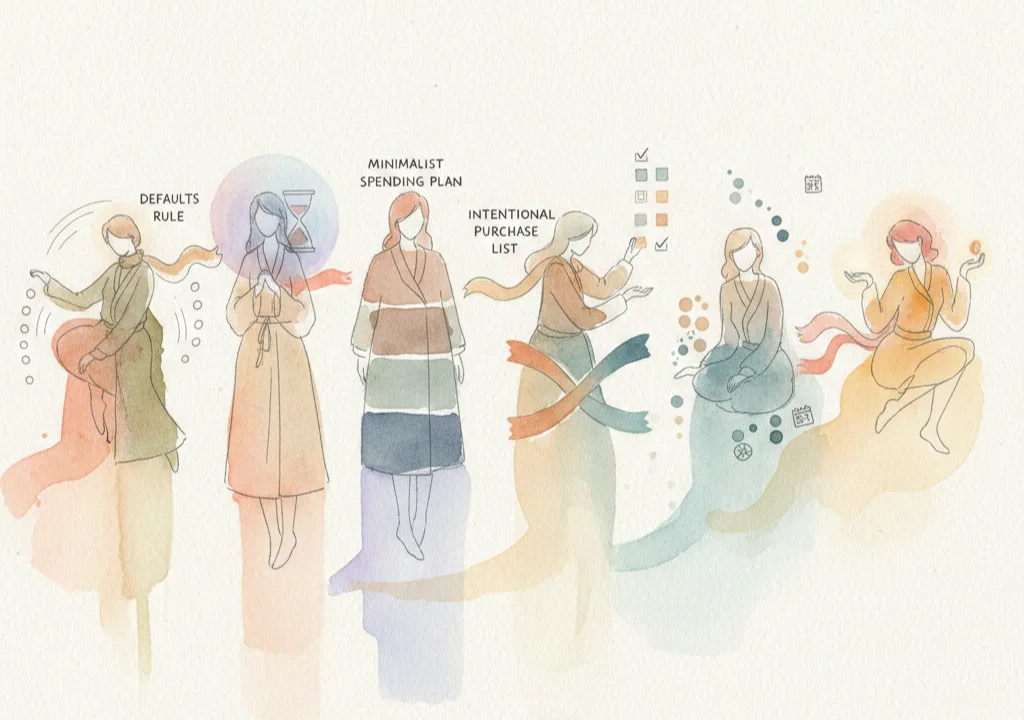

Seven minimalist spending habits that cut decision fatigue—defaults, pause rules, batching, intentional plans, and small experiments to reclaim mental energy.

Why minimalist spending reduces decision fatigue

Every day we make dozens of small money decisions: coffee or home brew, which shirt to buy, whether to subscribe to yet another app. Each tiny choice eats away at mental energy. Minimalist spending reduces that drain by turning repeat decisions into simple defaults and aligning purchases with what truly matters. The result: fewer choices, clearer priorities, and more headspace for the things that deserve your attention.

Below are seven minimalist spending habits that cut decision fatigue and make money feel less like a constant series of micro-battles.

Top 7 minimalist spending habits

1. Create repeatable defaults for everyday purchases

Decision fatigue fades fastest when you automate the small stuff. Choose one brand of coffee, one grocery list template, and one lunch rotation. Defaults don’t need to be permanent—they’re the mental scaffolding that frees up energy for bigger decisions.

How to start: pick three daily spending categories (coffee, groceries, commuting) and set a single, repeatable option for two weeks. If it still works, keep it. If not, adjust and try again.

2. Use a pause rule before non-essential buys

Impulse purchases are a major source of regret and mental clutter. A simple pause—24 hours for small items, 30 days for more expensive purchases—gives your initial urge time to cool and often reveals whether the item actually matters.

If you want a ready-made framework, the pause rule approach is covered in more detail in this guide on the pause rule habit.

3. Build a minimalist spending plan, not a punitive budget

Minimalist spending isn’t about cutting joy—it’s about aligning spending with values. Create a simple spending plan with three categories: essentials, values (what you want to spend on), and savings. Assign rough percentages rather than tracking every penny to avoid decision churn.

For a clear method to translate values into monthly allocations, see this short guide on creating an intentional spending plan for minimalists.

4. Reduce options with an intentional purchase list

Fewer options means fewer decisions. Keep an ongoing, intentionally curated list of items you’re allowed to consider buying in the next 6–12 months. When a new want appears, add it to the list instead of buying immediately. Once a month, evaluate the list and remove items that lost appeal.

This habit stops the “buy now, regret later” cycle and turns impulse energy into a calm review process.

5. Standardize purchases with a one-in-one-out rule for consumables

For non-durable goods—cleaning supplies, toiletries, pantry items—maintain a simple one-in-one-out rhythm. When you bring a new version of something into the home, remove an old or redundant item. Standardizing brands and sizes also simplifies reordering.

This approach reduces the number of open decision threads (“do we have enough dishwasher tablets?”) that hover in your mind.

6. Batch shopping and spending days

Batching consolidates decisions into a single session. Designate one or two shopping/spending days per week or month. Make all grocery shopping, bill payments, and discretionary purchases on those days. Batching shrinks repeated decision processes into predictable blocks.

Start small: pick one weekly slot (e.g., Saturday morning) and move grocery shopping and small errand purchases to that time only.

7. Lean into margin: keep a small discretionary fund

Decision fatigue spikes when every purchase feels consequential. Keep a small, easily accessible discretionary fund (a cash envelope, a dedicated debit card, or a separate account) for guilt-free small purchases. When minor wants come up, use that fund instead of debating whether to reallocate money from necessity or savings.

Set the fund size low enough to encourage thoughtfulness (e.g., $100–$300 monthly) but high enough to prevent constant trade-offs that sap mental energy.

How to make these habits stick

- Start with one habit: trying to adopt all seven at once increases decision friction. Pick the habit that will simplify your daily life the most (defaults and batching are often the quickest wins).

- Stack the habit onto something you already do. For example, add a monthly review of your intentional purchase list to the first weekend planning ritual you already have.

- Use micro-goals: aim to keep your pause rule for 7 consecutive purchases, then extend it.

- Track progress with simple signals, not spreadsheets: a checkmark on your calendar for each successful spending day is enough to build momentum.

Common traps and how to avoid them

- Mistaking austerity for minimalism: cutting everything leads to resentment and decision fatigue rebounds. Minimalist spending prioritizes what you value and reduces noise, not joy.

- Over-automation without review: defaults are powerful but eventually need revisiting. Schedule a quarterly check to ensure your defaults still align with your needs.

- Using the discretionary fund as a moral free-for-all: keep the fund honest by defining what it’s for (small treats, spontaneity) and what it’s not (large electronics, recurring subscriptions).

Small experiments you can try this week

- Default swap: pick one daily purchase and replace it with a single repeatable option for 14 days.

- Pause challenge: apply a 24-hour rule to every online purchase for one week.

- One-batch weekend: move all grocery and non-urgent purchases to one day and notice how much mental space that frees on other days.

These low-effort experiments reveal how much of your daily mental load comes from small money choices.

Final note: less choice, more clarity

Minimalist spending isn’t about deprivation; it’s about clarity. By designing simple defaults, pausing on impulses, batching decisions, and keeping a small margin for delight, you’ll shave off dozens of draining micro-decisions each week. The payoff isn’t just a healthier bank balance—it’s a quieter mind that can focus on the things that matter.

If you want a quick next step, pick one habit from the list and commit to it for 14 days. Small, consistent changes compound into a life with fewer decisions and more presence.